When we began working with the brand, it was evident that retention was a largely underexplored area. Despite being in a high-repeat category like baby and parenting, the brand had several foundational gaps, including:

No structured retention journeys implemented.

WhatsApp was not being effectively used as a revenue or lifecycle channel

Customer communication was highly limited to transactional updates

No CRM or automation tool existed to manage lifecycle messaging

Retention revenue contribution was effectively close to zero

However, the category itself also came with real-time challenges such as:

Parents are emotionally overwhelmed and short on time

Bombarding them with messages can lead to quick opt-outs

Aggressive discounting risks long-term brand credibility

What parents need changes rapidly as their baby grows

The central problem wasn’t just “low retention.” It was how to build retention without spamming, over-discounting, or overwhelming already over-stimulated parents.

Step 1: Laying the Foundation

Bik.ai as the CRM and WhatsApp Automation Platform was introduced

Established WhatsApp as a lifecycle channel, with accountability as our first priority.

A conscious decision to not use email initially was made, keeping the effort focused on a single, high-attention channel.

We prioritised reliability, trust, and clarity before pushing repeat purchases.

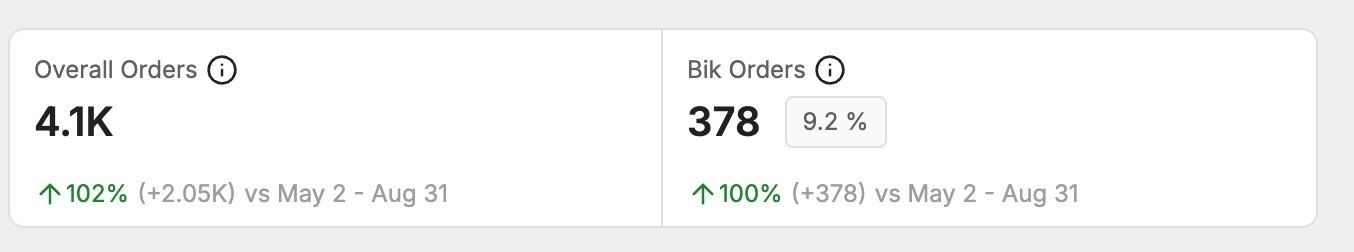

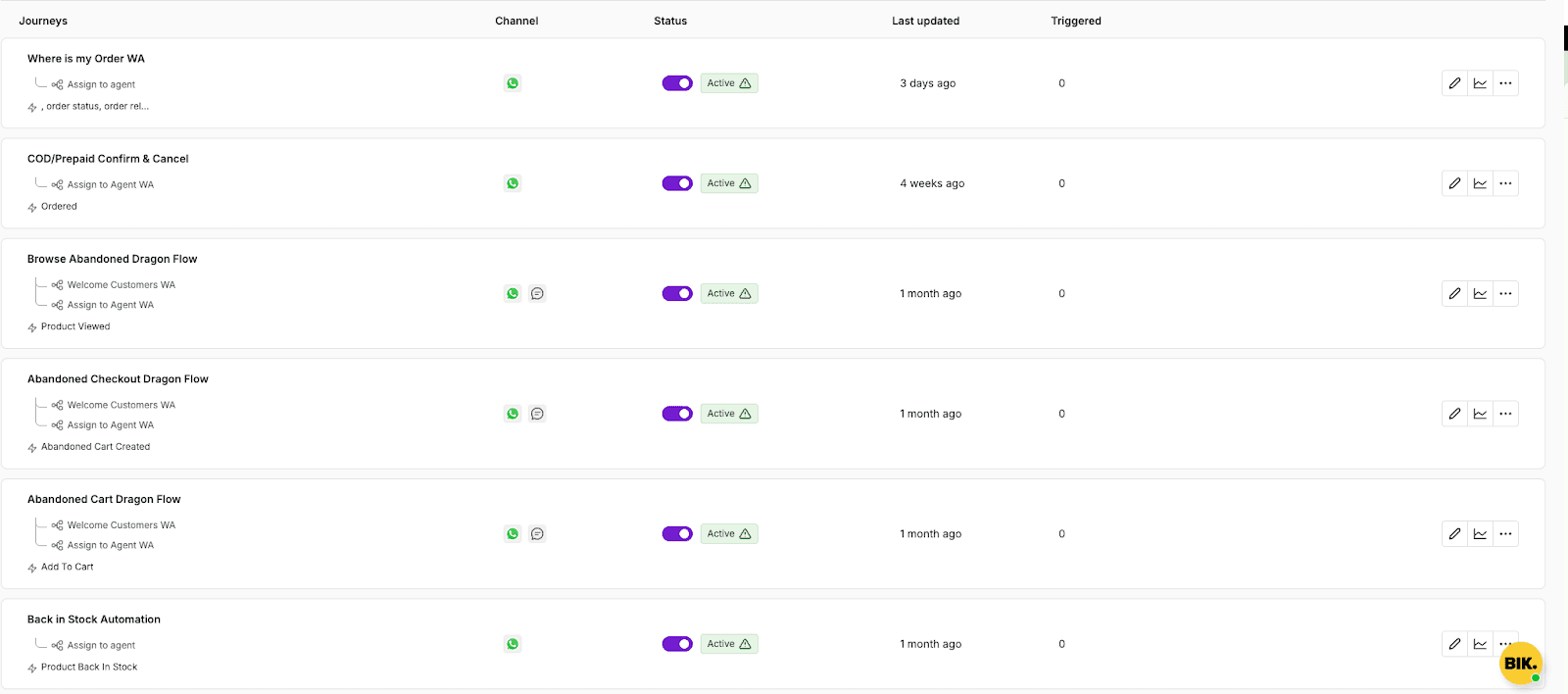

Overall orders reached 4.1K, reflecting a 102% increase (+2.05K), out of which Bik contributed 378 orders, accounting for 9.2% of total orders.

Step 2: Building Core Journeys First

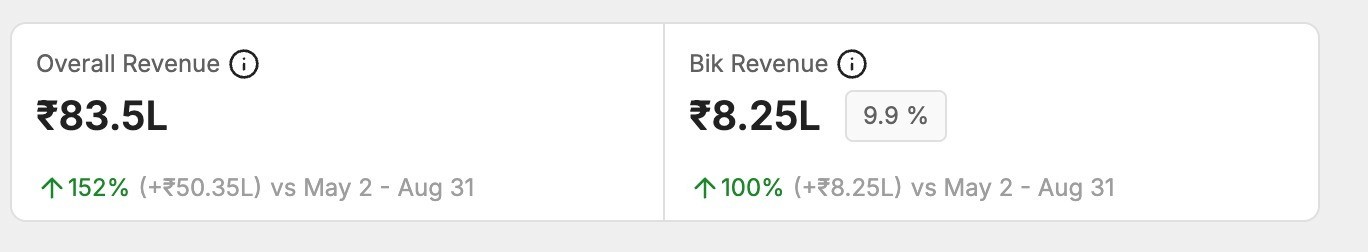

Our focus was shifted to essential hygiene journeys to plug obvious leaks such as:

Order updates (confirmation to delivery)

Abandoned checkout, cart, and browse flows

Welcome journey on WhatsApp opt-in

Post-purchase thank-you and check-in messages

COD confirmation and prepaid nudges

Post core-journey rollout, overall revenue reached ₹83.5L (+152%), with Bik contributing ₹8.25L (9.9%) .

This image illustrates the core hygiene journeys actively implemented across the customer lifecycle to reduce drop-offs and strengthen conversion.

Step 3: Segmentation Before Scale

Once the basic hygiene journeys were in place, the next step was to make messaging more relevant for parents. Instead of sending generic updates, we grouped parents based on behaviour and value. As hygiene, these are the segments we created based on RFM:

High Spender

Mid Spender

Low Spender

Recently Active vs Lapsed

COD vs Prepaid Buyers

Category Preferences (furniture, essentials, fashion, gifts)

This approach allowed for the right messages to reach the right individuals, reducing fatigue while keeping communication personalised.

Step 4: Layering Intent and Restock Logic

Once the foundation was stable, we expanded into more targeted, intent-driven flows. This included:

Personalized post-purchase product recommendations

Diaper restock reminders based on pack size and usage

Back-in-stock alerts

Drip campaigns for engaged users who hadn’t converted

Category-specific winback campaigns

Parenting-led journeys were introduced by asking parents their child’s age and placing them into tailored flows (Expecting, 0–12 months, and Gift Buyers).

Throughout, campaigns were used sparingly, always to support the journeys rather than replace them, keeping communication relevant and helpful.

Results

These were the advancements observed within just a few months of rollout: ‘

The brand now had a repeatable, scalable retention system, rather than relying on one-off campaigns, giving them a foundation they could expand on confidently.

WhatsApp-led engine that contributed around ~10% of total revenue

Read rates between 70-85% and ROAS reaching up to 15x.

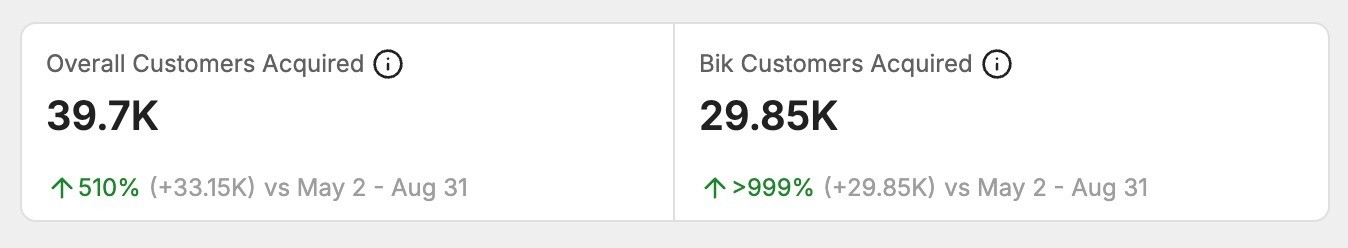

Out of the total 39.7k orders, our retention plan helped acquire 29.85K customers. The magnitude of growth indicates that the strategy efficaciously converted latent demand into active customers.

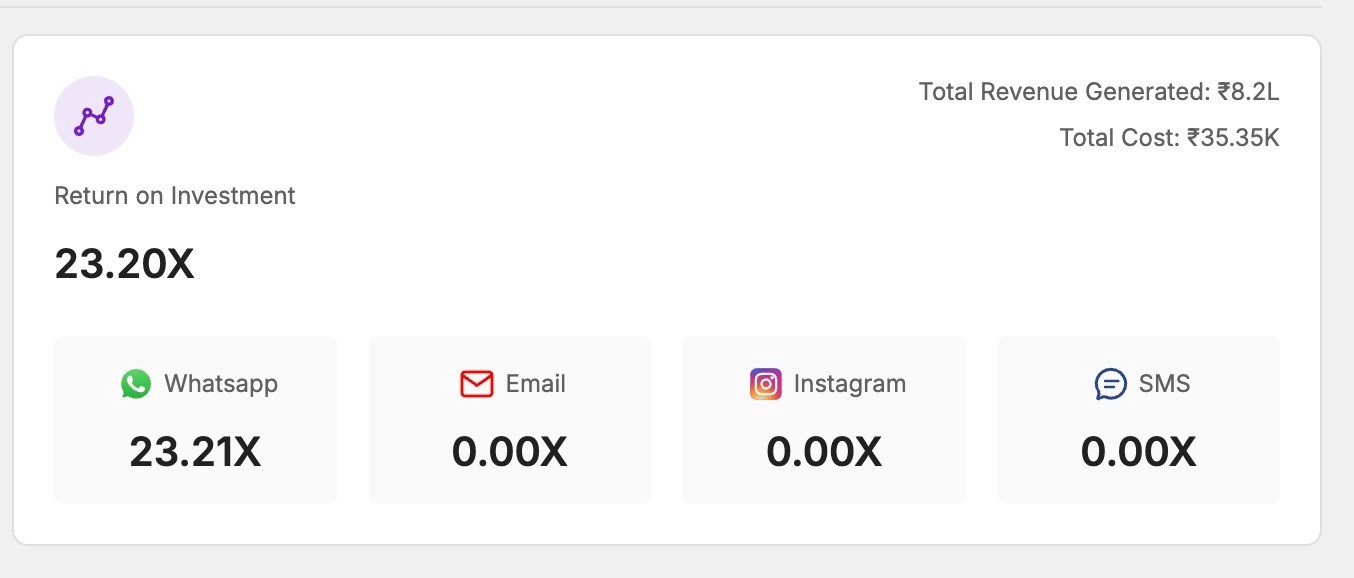

ROI analysis indicating ₹8.2L in total revenue against ₹35.35K in total cost, resulting in an overall ROI of 23.20×, with WhatsApp-specific ROI at 23.21×.

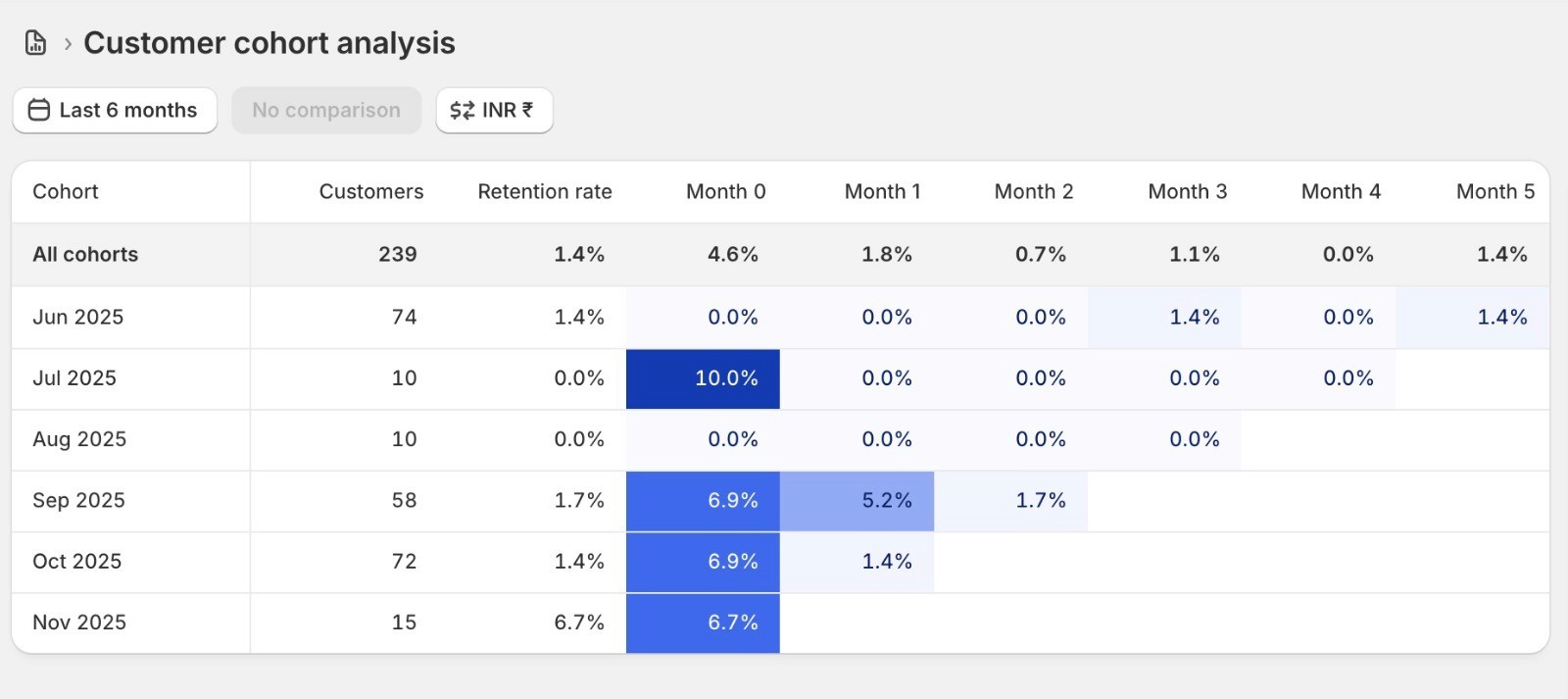

Cohort analysis displaying improving customer retention and sustained revenue contribution across successive cohorts.

Building retention in the parenting category came with major constraints. Parents are highly sensitive to message overload, timing matters more than frequency, and educational or emotional content often outperforms discounts. We addressed these by:

Introducing phased rollouts instead of big-bang launches

Regularly reviewing engagement and drop-offs

Initiating SMS only when WhatsApp delivery failed

Continuously refining journeys based on available data

The biggest learning: Retention works best when it feels like guidance, not marketing.

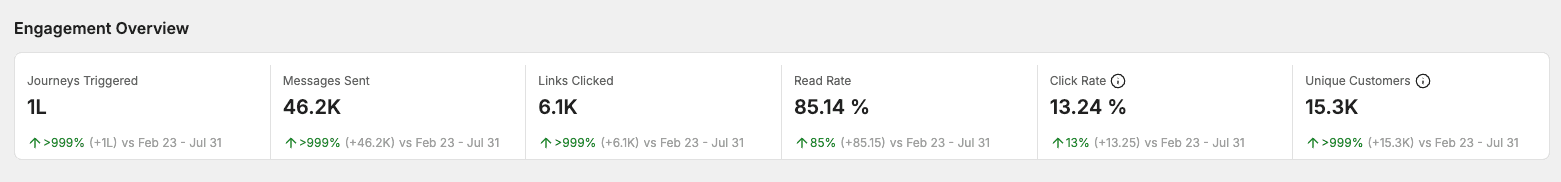

Engagement review across core journeys, showing metrics on journeys triggered, leads closed, messages sent, click rate, read rate, and unique customers.